The journey of selling a business demands careful consideration and knowledge. Among the myriad of choices available to sellers, one option particularly worth considering is the decision to work with an advisory firm that belongs to an M&A network with worldwide reach and expertise.

Globalscope Partners is one such network, and I as an M&A advisor chose to join it for a myriad of reasons—all of which offer tangible benefits to the sellers we represent. In this brief overview, I’d like to touch on a few.

A World of Advantages

The world of mergers and acquisitions is where the intricacies of negotiations, market dynamics, and strategic decision-making converge. The scope of such converging forces is one reason why an M&A network like Globalscope can be so important to sellers.

Globalscope member firms employ hundreds of mid-market M&A advisors that bring a wealth of international expertise, industry insights, and a collaborative ethos that are typically unavailable in the mid-market arena.

The key concept in this case is “mid-market.” Most mid-market transactions aren’t large enough to merit the attention of the big M&A advisory firms, so for the most part, sellers in the international mid-market space have largely been on their own.

The Globalscope network, however, levels the playing field between mid-market companies and huge enterprises that want to sell in the international arena. With a global M&A network model, all stakeholders in a middle-market transaction come out ahead.

Market environment

Let’s explore the competitive landscape to gain a deeper understanding of the alternatives available to businesses contemplating a strategic transition—as well as how Globalscope combines the benefits of each specific option.

Traditional Investment Banks

Esteemed for their long-standing presence and global outreach, traditional investment banks offer a wealth of experience. Some sellers, however, may find them less personalized and missing the tailored touch that a more flexible, hands-on partner offers.

Boutique Advisory Firms

Specializing in specific industries or regions, boutique firms provide sellers with targeted expertise. Despite their personalized approach, they often lack the expansive network a worldwide partnership like Globalscope provides.

In fact, when boutique advisory firms collaborate on a deal, a business seller in the mid-market space can actually get the best of both worlds. Boutique firms typically focus on one or a few market segments in which they have particular expertise.

In most cases, boutique firms are also more accustomed to working in tandem with sellers who not only have business but personal and family goals to consider as well. Combining mid-market, sector and geographical expertise into a seamless team of advisory professionals offers the seller a much stronger value proposition.

Independent Advisors

Individual advisors also offer close working relationships, but again, the challenge lies in the scale and global reach these advisors can provide. Globalscope’s M&A network, with 55 member firms and 500 investment bankers worldwide, offers sellers a comprehensive and far-reaching approach without hindering the advisor’s independence.

Online Marketplaces

The rise of online platforms has introduced a digital dimension to the M&A landscape, offering streamlining connections between buyers and sellers. But these platforms alone often fail to provide the depth of strategic guidance that sellers need. What’s more, they usually cater to very small businesses.

Regional Players

In specific regions, sellers may prefer an M&A advisory firm with a deep understanding of their local market. While local insights are highly valuable, regional firms typically lack the global expertise needed to optimize cross-border transactions.

The Globalscope M&A network fills in the gap by offering sellers both local and global M&A expertise.

DIY Approaches

The do-it-yourself approach is always an option, and it’s often the preferred one for business sellers who want to maintain a high level of control. But navigating the complexities of M&A transactions independently comes with considerable risks—especially if the company is a larger enterprise with multiple employees, intricate market dynamics, and diverse stakeholders.

It’s true that working with professionals does cost the seller more money at the outset. The benefits, however, far outweigh the risks. What you pay for in professional services is a fraction of what a seller can get back through better terms and a higher sales price.

These benefits are even more tangible when a network of professionals is involved versus one advisor alone. Globalscope’s streamlined approach to working with multiple member firms offers a balanced solution that can minimize costs and maximize the opportunities at hand.

Going Global with (or without) an International M&A Network

Whether a seller chooses to work with an M&A advisor or not, the possibility of an international sale should always be on the table. Selling in the international arena can offer several advantages compared to selling domestically.

Here are some potential benefits every business seller should be aware of when it comes to a cross-border sale.

Market Expansion

Selling internationally allows businesses to tap into new markets and reach a larger customer base, providing opportunities for growth that may not be available in a domestic market alone.

According to a December 2022 article in Forbes, international M&A deals were at an all-time high in 2021, totaling more than $2.1 trillion worth of transactions. This represents roughly 36% of all M&A transactions that year.

In 2022, the cross-border total dropped to around $1.1 trillion, representing around 32% of the global volume. Although the dollar figure declined significantly, the cross-border percentage of global versus domestic M&A activity stayed relatively the same.

The growth benefits that come with expanding internationally are one of the main reasons why cross-border deals continue to represent a sizable percentage of all M&A transactions.

Diversification

International sales also help businesses diversify their revenue streams. Depending on market conditions and economic trends, a company may be less vulnerable to downturns in a specific country or region.

Again, such considerations help drive demand, and the resulting benefits impact buyers and sellers alike.

Increased Revenue

Access to larger markets means the potential for increased sales and revenue. This is particularly true if a product or service meets the needs of consumers in different cultures and economic contexts.

The promise of increased revenue is a particularly strong attraction for anyone who wants to sell their business. Like the buyers and sellers involved, employees and other stakeholders—especially those who remain with the new entity—will see the potential for higher revenues as a favorable indicator of their own benefits.

Economies of Scale

International expansion can lead to economies of scale that might not be possible through a domestic sale alone. An international playing field often offers economies in bulk purchasing, production optimization, and distribution improvements that ultimately contribute to cost savings.

Such economies of scale make a potential M&A transaction more attractive to all parties involved.

Innovation and Learning

Cross-border ownership exposes a company and its workers to diverse work norms, cultural nuances, and business practices. This can stimulate innovation and help a company stay adaptable and responsive to changing market demands.

Access to Talent and Resources

An international sale can also provide access to a broader talent pool, specialized skills, and resources that may not be readily available domestically.

More talent and greater resources significantly enhance a company’s capabilities and competitiveness, and international mergers are one of the fastest ways to expand a firm’s resources strategically.

Risk Mitigation

Relying solely on one market can expose a company to risks associated with economic downturns, regulatory changes, political instability, or any number of other scenarios that negatively impact the business.

Diversifying internationally can not only mitigate these risks, it can also improve the perceived desirability of the seller’s company if the acquisition offers the potential to lower the company’s domestic risk factors.

Brand Recognition

Expanding globally enhances a company’s brand recognition and reputation, and a cross-border sale lays a firm foundation for making it happen in a shorter time frame.

In fact, whether it’s the seller or the buying company that enjoys the stronger brand image prior to joining forces, both entities can benefit from the synergies an international presence can bring to a brand.

Strategic Alliances and Partnerships

International expansion also offers opportunities to form strategic alliances and partnerships with foreign businesses. Cross-border collaborations can lead to shared resources, knowledge transfer, and mutually beneficial relationships—no matter where the buyer and seller were originally based.

Competitive Advantage

Ultimately, the combined benefits of a successful cross-border M&A transaction gives the newly merged company a competitive advantage over competitors who just operate domestically.

It not only allows the newly combined company to enter new markets before its competitors do so, it also provides the business with a wealth of resources that were either unavailable or unfeasible before the merger.

It’s important to note, however, that international acquisitions also come with challenges such as cultural differences, regulatory complexities, and logistical issues.

A careful assessment of these factors and a well thought-out growth strategy are crucial for successful business operations. And that’s where M&A advisory networks like Globalscope can really add value.

A World of Opportunities

With offices in 46 countries, Globalscope gives sellers access to an extensive and diverse pool of international buyers. Such expansive reach not only broadens the market for sellers, but also increases their visibility on an international scale.

A global footprint isn’t just a statistic. It’s a strategic asset for sellers seeking to get as much as they can from their transaction. For example, imagine a Life Sciences company contemplating a strategic sale.

Globalscope has a Life Sciences group that offers specialized knowledge in this specific sector. The combination of sector expertise and global capabilities ensures sellers are working with a team tailored to meet their individual needs.

Not only does this approach eliminate much of the learning curve, but working with an industry specialist can also help the seller raise valuations.

In fact, I believe sector-specific knowledge is increasingly mandatory for all middle-market transactions, not just cross-border deals. Globalscope offers extensive experience and global expertise in multiple sectors beyond Life Sciences including:

- Consumer

- Business & Financial Services

- Industrials

- Energy Transition

- Technology, Media & Telecom (TMT).

Specialty expertise also makes Globalscope more than a transactional partner in each sector. Deep category knowledge helps an advisor play a strategic role from the very beginning as well as throughout the M&A process. Areas in which one advisor may lack hands-on experience and expertise are covered by working in tandem with a partner who does.

Collaboration is Key

Collaboration lies at the heart of Globalscope Partners, a network that includes 55 member firms and is supported by hundreds of investment banking professionals worldwide.

Scale alone sets Globalscope apart as a resource for cross-border M&A middle-market services. The real power of the network, however, is the commitment members have to working together to get the very most they can for our clients.

Whether navigating complex financial structures, assessing market risks, or crafting innovative deal structures, Globalscope’s network of investment bankers stands as a testament to its ability to deliver comprehensive and sophisticated solutions.

As sellers embark on the intricate journey of business transition, the backing of investment bankers within Globalscope’s network becomes a strategic advantage. It’s not merely about the quantity but the quality of expertise that this extensive network brings to the table.

Sellers can rest assured they are not just navigating the M&A landscape; they are navigating it with a team of professionals who bring a wealth of experience, a global perspective, and a commitment to excellence.

A Seamless Solution

For sellers embarking on the intricate journey of business transition, the decision to partner with M&A advisory firms within a global network holds the promise of being transformative.

A global advantage, in-depth market knowledge, tailored advisory services, streamlined processes, and the power of an international network collectively contribute to an unparalleled experience for the seller.

As businesses evaluate their options for M&A advisory services, the unique benefits of Globalscope make it an attractive choice no matter where you are in the world. That’s why I chose to become a member myself. My firm and the sellers we work with are seamlessly connected to a world of greater possibilities.

# # #

Marcin Majewski is the Founder and Managing Partner of Aventis Advisors. Based in Warsaw, Poland, Aventis Advisors is an M&A advisory firm focusing on technology and growth companies. (marcin.majewski@aventis-advisors.com)

Before we discuss why buying businesses in India is a smart move—whether you’re from the Subcontinent or not—here are some staggering facts to consider:

- India is now a country of 1.4 billion people and has surpassed China as the world’s most populous nation.

- According to Goldman Sachs, India will be the third-largest economy behind the U.S and China in the relatively near future.

- Eventually, India will have more purchasing power than the U.S.

- India is in the midst of a massive infrastructure improvement initiative: the number of roads, airports, and ports have doubled in recent years, and India has one of the largest rail networks in the world.

- India’s digital infrastructure is highly advanced, and currently boasts an intranet subscription rate of around 900 million people—nearly three times the entire population of the United States.

That’s just the tip of the iceberg. Yet, when it comes to desirable merger and acquisition business locations in the world, India is all-too-often far from top-of-mind considerations.

The time has come, however, for that to change.

Five Reasons why buying businesses in India can indeed be a smart investment.

According to Deloitte—despite the devastating impact of COVID—overall M&A deal activity in India has grown from 557 transactions in 2028 to 911 deals in 2022, a 53% uptick over a 5-year period.

Based on all indicators so far, it’s safe to say that buying businesses in India will not only continue to grow in coming years, but unless something happens to truly upset the world’s economy in the future, demand for M&A deals in India is very likely to skyrocket.

Here are five reasons why:

- Economic Growth

India has been experiencing steady economic growth for some time now, making it an attractive (if not ideal) market for business expansion and investment for medium-sized businesses, international companies. and global giants alike.

- Large Consumer Base

With the largest population in the world, India offers a vast consumer market with ample opportunities for companies to tap into a wide customer base.

- Young Workforce

India has a youthful and increasingly skilled workforce, offering a demographic dividend for companies looking for talent and human resources.

- IT Hub

India is also a global IT outsourcing hub, especially known for its software development and technology services. Acquiring companies in the IT sector can provide skilled professionals and technological expertise that isn’t readily available in many parts of the world.

- Strategic Location

And what it often one of its most overlooked benefits, India’s geographic location makes it a strategic gateway to both the Middle East and Asia. Its strategic location provides opportunities for companies to establish regional headquarters or expand their presence in neighboring markets that are often critical to international brands.

But there is much more. India has built its own 5G network, connecting millions of people with each other. The National Payments Corporation of India has also developed a Unified Payment Interface (UPI), which allows mobile devices to instantaneously transfer funds between two bank accounts.

UPI not only makes payments easier, faster and more cost effective, it literally has the ability to become a game-changer for a whole new generation of digital payment technology and payor preferences.

Although there are countless other reasons why buying businesses in India continues to gain momentum, perhaps the most important one is that India’s ascent on the international stage continues to move it closer and closer into the spotlight.

The IMF has identified the Indian rupee (INR) alongside China’s renminbi (RMB) as a potential international currency. In fact, a joint statement from the BRICS Ministers of Foreign Affairs and International Relations after a meeting of its foreign ministers on June 1, 2023 underscored the need for members to use their own currencies in lieu of the standard ones in international trade.

In short: the notion of the rupee as becoming a highly respected reserve currency isn’t a mere pipe dream. It actually may not be far off.

As far as the West’s perception of India, however, there may be some lingering bias that investing in India is the sole domain of the world’s leading organizations and brands. But nothing could be farther from the truth.

The same benefits that make buying businesses in India an attractive option for the world’s global giants still apply for small and medium-sized firms. India is ripe for M&A investment now, no matter what size the buyer or selling entity might be.

Pankaj Rungta is the Founder and Managing Partner of Rungta Advisors. Based in Pune, India, Rungta Advisors advises and executes private equity transactions across a broad range of industry sectors. He can be reached at pankaj@rungtaadvisors.com.

It may seem like a bold endeavor to assess the current state of mergers and acquisitions in Ukraine, given the tragic and devastating invasion that has plagued our country ever since that infamous day on February 24 of last year.

But the benefits of an M&A assessment more than merit its undertaking.

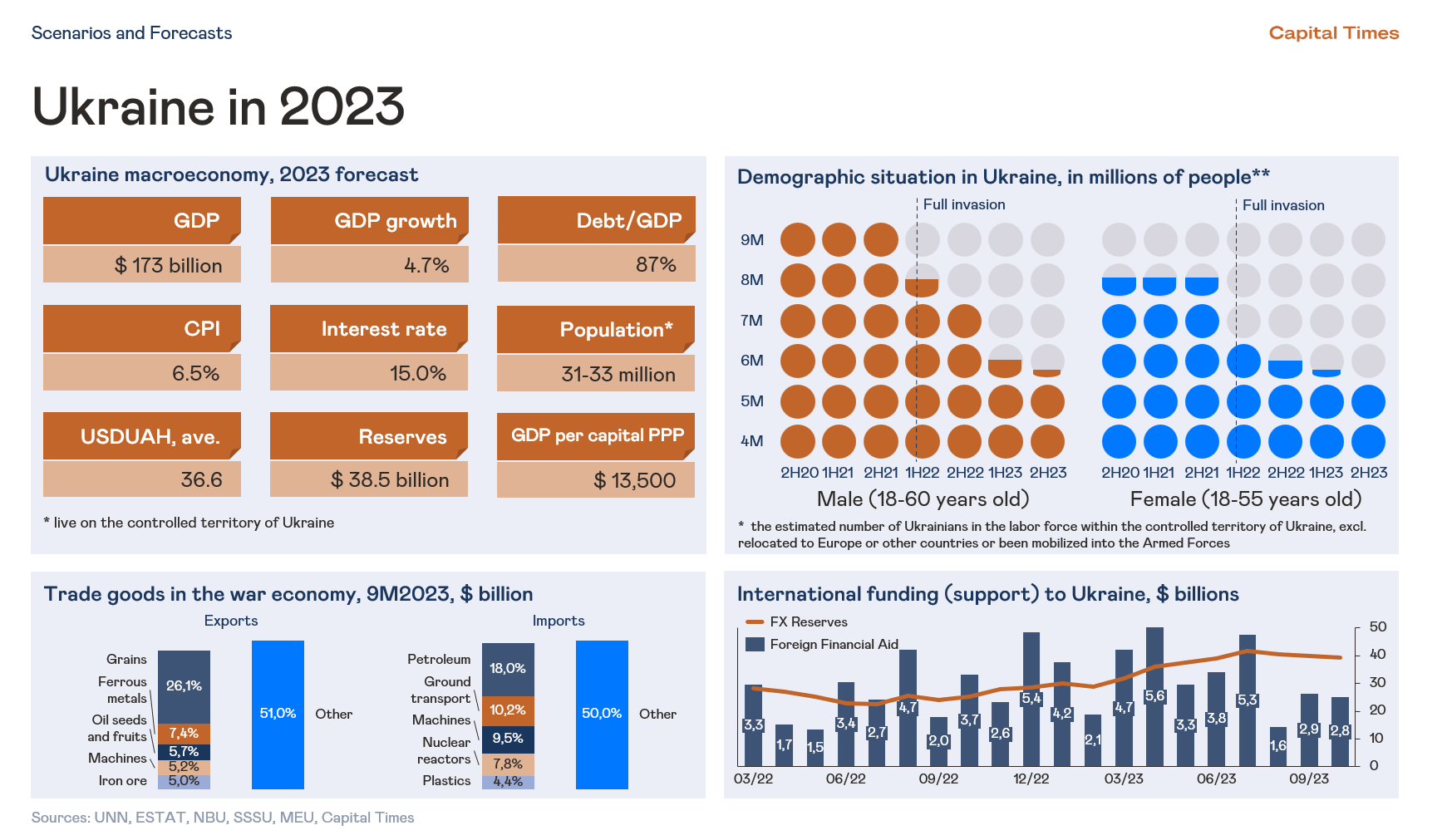

It’s quite true that, at the moment, no one can paint a completely accurate—or at least static–picture of the Ukrainian economy. According to Trading Economics global macro models, GDP in Ukraine is forecasted to reach 164 USD billion by the end of 2023.

Capital Times, a Globalscope member from Ukraine, however, is more optimistic. We don’t expect the war to end next year, but the current economic trajectory is growing to 173 USD billion in 2023, and to 190 USD billion in 2024. The recovery path gets support from the defense sector and international funding.

The current 2023 GDP figures are the aftermath of a 29% decline in 2022 due, of course, to the destruction brought on by the unforeseen war with Russia. No matter how determined and committed Ukrainians may be to restoring our country to ongoing economic health, the harsh reality is that it will take years before the economy can reach anywhere near its pre-war levels.

Mergers and Acquisitions in Ukraine: A Different Trajectory

Unlike the macro economy itself, merger and acquisition opportunities in Ukraine are far more robust, even today. Whether Ukraine eventually joins NATO or not, Ukraine has made major strides in aligning itself closely with the West.

This emerging relationship creates countless M&A and joint-venture opportunities for rebuilding the nation as quickly as possible, and will certainly create alliances and emerging sectors that can catapult Ukraine to new heights.

Many dark days and risks still lie ahead, but I believe the time to start aggressive M&A planning is today—not tomorrow, or even later on when this terrible episode in our history is over once and for all.

So, how does a corporate buyer, seller, investor, or other stakeholder approach the Ukrainian market with a measurable degree of confidence while fighting on both sides continues? The answer certainly isn’t simple, but for the most part, it’s definitely straightforward.

And that answer is outsourcing.

Parties involved in cross-border M&A transactions with Ukraine must outsource at least part of their resources to Ukrainian financial advisors and other experts with on-the-ground experience and a proven history of success they can bring to the table.

In the fast-paced world of investment banking, precision and effectiveness are paramount. That’s where Capital Times steps in with specialized outsourcing services designed to streamline operations, enhance efficiency, and boost profitability for investment banks. Our customized solutions include:

- Cost Reduction

By using Ukrainian-based outsourcing services, companies typically save money by eliminating the need to hire their own personnel for tasks that are more quickly completed and better understood by native financial experts. Examples include lower labor costs and fewer office expenses.

- Greater Efficiency

Instead of a broad range of services, outsourcing companies usually provide customized support more qualitatively, judiciously, and efficiently. It also helps reduce the risk of human factors by eliminating dependence on employees who are underperforming or delivering less than what is expected. With outsourcing, unforeseen personnel issues are corrected far more quickly and less disruptively.

- Risk Reduction

This critical benefit speaks for itself. Outsourcing companies offer professional experience and skills that allow them to manage risk more effectively, and they are more apt to ensure strict compliance and adherence to local regulatory standards. All of which are essential for a more successful transaction from the very beginning.

- More Clearly defined Focus

Outsourcing also allows the ability to allocate specific tasks to the appropriate partner. While cross-border companies can focus more heavily on business development and customer acquisition, the outsourced partner can provide access to additional resources and specialized expertise that would otherwise be lacking.

- Speed and Flexibility

Outsourced companies usually demonstrate faster and more flexible responses to new market demands in their local areas. This benefits everyone involved by reducing reaction time and adapting to changing conditions and unforeseen scenarios.

- Time Zone Advantage

Ukraine’s time zone alignment, with an 8+8 working day, ensures extended service hours for investment banks serving American and Asian clients, enhancing operational efficiency and client responsiveness. This strategic advantage minimizes communication delays and supports short-term and long-term success.

While outsourcing is a potent tool for achieving business goals, it’s essential to recognize that it’s not a one-size-fits-all solution. Success in outsourcing relies on conducting a comprehensive needs analysis, collaborating with a highly professional team, optimizing outcomes for all parties involved, and ensuring the quality and discretion demanded by the business.

Capital Times exemplifies how a well-planned outsourcing strategy can contribute to both short-term financial benefits and long-term success, with remarkable improvements measured at around 20% in cost reduction, 15% in enhanced efficiency, 25% in risk reduction, 30% in sharper focus, and 20% in speed and flexibility across various key performance indicators.

# # #

Author

Artem Shcherbyna, PhD, MBA, is Chief Investment Officer and Head of R&D at Capital Times.

He has 13 years of experience in asset management and investment analytics.

One of the leading macroeconomists in Ukraine, in 2021 he foresaw the risk of a full-scale Russian invasion as a worst-case scenario for Ukraine.

a.shcherbyna@capital-times.com

Successful middle-market mergers and acquisitions (M&A) require a multi-faceted approach that can differ significantly from multi-billion-dollar transactions. At the most fundamental level, every M&A deal always involves a combination of financial, strategic, legal and operational expertise. But in international transactions, the value of cross-border middle-market experts are critical because the needs are often much more specific. Interpersonal expertise, local market knowledge, and cultural integration, for example, are far more critical concerns.

By ignoring the differentiating factors—especially the personal and foreign dynamics involved in cross-border M&A—the opportunities for long-term success are uncertain at best. Which is where Globalscope comes in.

Although there are many advantages of working with a global network of middle-market M&A experts, there are four key reasons why buyers and sellers alike need the expertise of a network like Globalscope. In the cross-border middle-market space in particular, all stakeholders need deep capabilities in:

- Local Legal and Regulatory Expertise

- Communication and Change Management

- Cultural Integration

- And personal needs and priorities.

Local Legal and Regulatory Expertise in Cross-Border Transactions

In reality, there is no such thing as a global market. There are only local markets that operate in an international arena. The norms that work in one country are often dramatically different from what is common in another.

In middle-market cross-border transactions, this is a particularly critical issue. You’re usually working with two-to-three markets at the most. So, the need to understand the legal and regulatory requirements for each specific market is usually more in-depth than what you’ll find in multinational transactions on an enterprise scale. With the Globalscope model, the approach is to provide you with the expertise and experience you need in each specific region per se—not a generic strategy with tip-of-the iceberg market compliance.

Communication and Change Management

It’s hard enough to manage communication and change-management issues in a domestic M&A process, but when different countries, different languages, and different cultural backgrounds are involved, the challenge is considerably more daunting—and much more important.

No two cultures are exactly alike, and as anyone who has worked with a foreign partner can tell you, it’s not uncommon to think both of you are on the same wavelength, only to find a couple of weeks later that neither one of you understood what the other was saying at the time. The scenario is even more challenging if foreign languages are involved.

In multi-billion-dollar cross-border transactions, individual cultural missteps are less damaging, simply because inadvertent cultural mistakes in a single region don’t damage the transaction as a whole, and they can be corrected over time. But when the work is between one country (or even region) and another, part of the advisor’s charge is to protect the client against cultural mistakes that can literally scuttle the deal. That’s why a network like Globalscope is so important in a cross-border middle-market scenario. The M&A team includes native experts on both sides of the transaction, each of which brings years of experience and local market knowledge to the table.

Cultural Integration

Integrating the different cultures as seamlessly as possible is a major priority in cross-border transactions. Just as no two counties’ cultures are exactly alike, neither are those of two different businesses. In fact, cultural integration is always a priority regardless of the size of the deal, but in the M&A space, the challenges are usually much more granular and specific. How do the cultural norms of each entity in general differ between the buyer and seller? What potential biases or cultural traditions must each stakeholder understand? Are there existing practices that could offend one of the parties unintentionally? How do the rules for management hierarchies differ from country to country?

The list of potential pitfalls is long, but with on-the-ground expertise on both sides of the coin, integrating disparate cultures is much easier—and far less risky—from the very beginning.

Personal Needs and Priorities

The personal aspects of the transaction are by far the biggest differentiator between middle-market deals and large-scale multinational mergers. More often than not, middle-market deals are either made between at least one privately held business and another, a company that has been owned by a single family or a closely knit group of shareholders for years, if not decades. What does or does not happen to the previous owners’ interests is always a central concern.

Again, the Globalscope model is designed to address the personal needs of all parties involved from the very beginning. This requires a positive chemistry with and among the financial advisors who must demonstrate legitimate concern for the people they’re dealing with. In the end, corporations don’t sell businesses. People do. And Globalscope is designed to optimize the business and personal outcomes that are both needed to maximize success.

# # #

John Sloan is president and CEO of Sloan Capital, LLC based in Dallas, Texas, USA. He specializes in selling, buying and financing businesses on behalf of privately owned companies. Learn more at sloancapitalllc.com.

By Mauricio Schutt | July 2023

In 2023 the investment opportunities for M&A in Brazil are both like and unlike the world’s other leading economies today. The same can be said about its economic advantages.

As the world’s 10th largest economy, Brazil has a healthy GDP of two trillion US dollars, a diversified market with more than 200 million consumers, multiple industries with a highly developed business services sector, vast mineral wealth, and a keen eye on foreign expansion.

It’s also a global power in the agribusiness sector and one of the world’s top-two exporters of agriculture in general. What’s more, Brazil is a democracy with a western-like culture that values both freedom and diversity, and it conveniently serves as a near-shoring or friendly-shoring for other western economies.

Yet, Brazil is not without its challenges nor its unique differences. The Brazilian government could have addressed several important issues at a much faster pace, but decades of tradition that favor a privileged few over the population as a whole are almost impossible to change overnight.

In the last five years, however, important reforms were approved regarding the social security system, employment contract relationships, and central bank autonomy. Furthermore, in 2023 the Brazilian Congress should approve tax system reform to both simplify it and to make it more comparable to other developed economies.

The good news is that Brazil’s ambivalent mix of economic advantages and disadvantages can offer M&A investment opportunities which aren’t available in other leading economic markets.

GDP per capita here is only 20-25% that of other developed countries. As the largest economy in Latin America, Brazil also offers a strong consumer market potential, a sophisticated financial market, internationally recognized expertise in several industries, and Brazilian unicorns, among other attractive advantages.

As a result, if your investment strategy and risk assessment are both on target, M&A in Brazil has many benefits to offer this year.

Scope Surpasses Scale

According to a 2023 report on M&A in Brazil by Bain Consulting, scope deals—whereby businesses change their target markets in a new way or enter a different sector of some kind—continue to grow significantly. So much, in fact, they’re noticeably outpacing the growth of scale-related deals, which basically focus on expanding operations that already exist.

Scope deals have steadily hiked their share of the total transaction market, increasing from 5% of Brazil’s total deal value in 2019, to 9% in 2020, and then to 21% in both 2021 and 2022. Conversely, the total percentage of scale deals has declined accordingly.

I think this is a particularly valid indicator of how strong the demand for long-term investment in Brazil actually is. By its very nature, growth in scope-based transactions corroborates the perception of Brazil as a country that merits long-term commitments.

Investments into new sectors, new markets, new products and new growth and expansion all underscore a company’s belief in the viability, not only of its own ability to succeed, but in the strength of the chosen economy in and of itself.

Inflation here has been in control since 1995. Currency fluctuation is far less risky, largely due to an enormous trade balance and $US350 billion in reserves; and labor reforms approved in 2018 have significantly reduced labor litigation.

Together, all of these factors continue to build Brazil’s reputation as an increasingly attractive investment location on a global scale—for the world’s $multi-billion giants and mid-sized companies alike.

Mauricio Schutt is a Partner in Pactor Finanças Corporativas, an M&A and consulting services firm focused on the Brazilian market. For more information on M&A in Brazil, contact him at mauricio@pactorfc.com.br.

Cross-border M&A fell to $1.57 trillion worldwide in 2022, down from an all-time high of $1.7 trillion in 2021, according to Pitchbook, a financial database. The number of international deals actually dropped to 9156, a total decline of 11%.

But from a broader perspective, it’s not particularly bad news. As a comparative trend, cross-border M&A transactions are still higher than they have been historically, in spite of the more recent—and potentially temporary—slowdown.

Current economic and political challenges have created a combination of factors that have fueled uncertainty, caution, and a bit of a “wait until the storm passes” attitude in the minds of buyers, sellers, and financial lenders worldwide.

Three trends particularly stand out:

- Steadily increasing interest rates, combined with decreased availability of debt in certain regions, had an overall tempering effect on dealmaking last year, and to some extent, it still does in 2023.

- Geopolitical events, most significantly the war in Ukraine, took a measurable toll on international transactions—and confidence.

- Concerns about the impact of inflation worldwide add even more fear and hesitancy when it comes to cross-border M&A decisions.

Despite the recent slowdown, long-term trends in cross-border M&A are clearly upward

Long-term growth in cross-border M&A is driven by two major buyer groups:

- Large corporations who continue to expand their businesses into foreign territories and find that M&A is a faster and more certain way to gain access to new markets, rather than going “greenfield”.

- Private equity firms also increasingly deploy international buy-and-build strategies to accelerate the value creation process, especially after having acquired a first-platform company in a given industry.

PE firms have learned that breaking into new markets and turning a national leader into an international player has a directly positive effect on valuation levels when selling the company.

New Challenges, New Opportunities

This is not to say, however, that everything is rosy in the international M&A arena, nor is it by any means simple.

International mergers and acquisitions are driven by various factors, like reducing competition, penetrating new markets, diversifying product lines or services, and gaining rights to intellectual property such as patents, trademarks, and copyrights.

As a result, international M&A often follows trade. Most cross-border transactions take place between countries that do a lot of business with each other. And from a mid-market perspective, I estimate roughly 1/3 of M&A transactions are cross-border in the sense that the buyer and seller come from different countries. This number is typically higher in smaller countries like The Netherlands that are more accustomed to working internationally than their larger counterparts, such as the United States.

Manufacturing, consumer, and professional services have historically been sectors with high volumes of cross-border M&A, but during the last decade, technology, media, and telecom (TMT) have shown the largest increase in the number of deals and value.

The bottom line is that cross-border M&A adds further challenges to the already complex process that characterizes dealmaking. Cross-border transactions bring additional risk and complexity due to differences in cultural, political, economic environment, law, tax rules, and accounting, not to mention disparities in corporate culture itself.

But there is another bottom line to also consider. International M&A can offer a level of financial rewards and business growth that cannot be achieved by regional or national deals alone. More and more, M&A opportunities for mid-market companies are becoming increasingly international.

Cross-border M&A growth is good news for mid-market buyers and sellers who are looking for more strategic deals, increased market share, and worldwide expansion and growth.

Martijn Peters is Founder and Managing Director of DEX international M&A, a Netherlands-based company specializing in structuring and managing M&A transactions. He has broad experience as an international deal maker and currently serves as President of Globalscope Partners.