It may seem like a bold endeavor to assess the current state of mergers and acquisitions in Ukraine, given the tragic and devastating invasion that has plagued our country ever since that infamous day on February 24 of last year.

But the benefits of an M&A assessment more than merit its undertaking.

It’s quite true that, at the moment, no one can paint a completely accurate—or at least static–picture of the Ukrainian economy. According to Trading Economics global macro models, GDP in Ukraine is forecasted to reach 164 USD billion by the end of 2023.

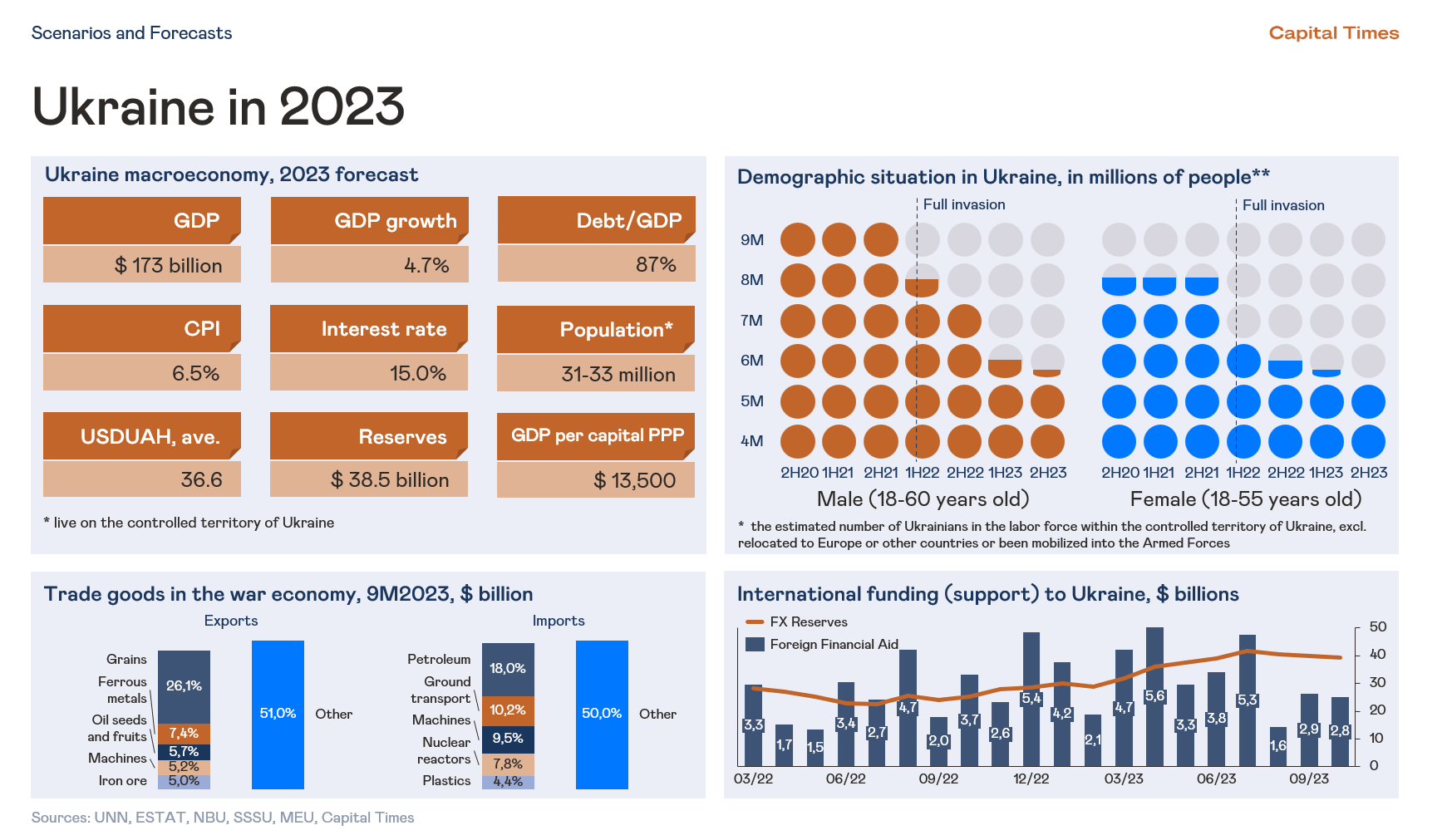

Capital Times, a Globalscope member from Ukraine, however, is more optimistic. We don’t expect the war to end next year, but the current economic trajectory is growing to 173 USD billion in 2023, and to 190 USD billion in 2024. The recovery path gets support from the defense sector and international funding.

The current 2023 GDP figures are the aftermath of a 29% decline in 2022 due, of course, to the destruction brought on by the unforeseen war with Russia. No matter how determined and committed Ukrainians may be to restoring our country to ongoing economic health, the harsh reality is that it will take years before the economy can reach anywhere near its pre-war levels.

Mergers and Acquisitions in Ukraine: A Different Trajectory

Unlike the macro economy itself, merger and acquisition opportunities in Ukraine are far more robust, even today. Whether Ukraine eventually joins NATO or not, Ukraine has made major strides in aligning itself closely with the West.

This emerging relationship creates countless M&A and joint-venture opportunities for rebuilding the nation as quickly as possible, and will certainly create alliances and emerging sectors that can catapult Ukraine to new heights.

Many dark days and risks still lie ahead, but I believe the time to start aggressive M&A planning is today—not tomorrow, or even later on when this terrible episode in our history is over once and for all.

So, how does a corporate buyer, seller, investor, or other stakeholder approach the Ukrainian market with a measurable degree of confidence while fighting on both sides continues? The answer certainly isn’t simple, but for the most part, it’s definitely straightforward.

And that answer is outsourcing.

Parties involved in cross-border M&A transactions with Ukraine must outsource at least part of their resources to Ukrainian financial advisors and other experts with on-the-ground experience and a proven history of success they can bring to the table.

In the fast-paced world of investment banking, precision and effectiveness are paramount. That’s where Capital Times steps in with specialized outsourcing services designed to streamline operations, enhance efficiency, and boost profitability for investment banks. Our customized solutions include:

- Cost Reduction

By using Ukrainian-based outsourcing services, companies typically save money by eliminating the need to hire their own personnel for tasks that are more quickly completed and better understood by native financial experts. Examples include lower labor costs and fewer office expenses.

- Greater Efficiency

Instead of a broad range of services, outsourcing companies usually provide customized support more qualitatively, judiciously, and efficiently. It also helps reduce the risk of human factors by eliminating dependence on employees who are underperforming or delivering less than what is expected. With outsourcing, unforeseen personnel issues are corrected far more quickly and less disruptively.

- Risk Reduction

This critical benefit speaks for itself. Outsourcing companies offer professional experience and skills that allow them to manage risk more effectively, and they are more apt to ensure strict compliance and adherence to local regulatory standards. All of which are essential for a more successful transaction from the very beginning.

- More Clearly defined Focus

Outsourcing also allows the ability to allocate specific tasks to the appropriate partner. While cross-border companies can focus more heavily on business development and customer acquisition, the outsourced partner can provide access to additional resources and specialized expertise that would otherwise be lacking.

- Speed and Flexibility

Outsourced companies usually demonstrate faster and more flexible responses to new market demands in their local areas. This benefits everyone involved by reducing reaction time and adapting to changing conditions and unforeseen scenarios.

- Time Zone Advantage

Ukraine’s time zone alignment, with an 8+8 working day, ensures extended service hours for investment banks serving American and Asian clients, enhancing operational efficiency and client responsiveness. This strategic advantage minimizes communication delays and supports short-term and long-term success.

While outsourcing is a potent tool for achieving business goals, it’s essential to recognize that it’s not a one-size-fits-all solution. Success in outsourcing relies on conducting a comprehensive needs analysis, collaborating with a highly professional team, optimizing outcomes for all parties involved, and ensuring the quality and discretion demanded by the business.

Capital Times exemplifies how a well-planned outsourcing strategy can contribute to both short-term financial benefits and long-term success, with remarkable improvements measured at around 20% in cost reduction, 15% in enhanced efficiency, 25% in risk reduction, 30% in sharper focus, and 20% in speed and flexibility across various key performance indicators.

# # #

Author

Artem Shcherbyna, PhD, MBA, is Chief Investment Officer and Head of R&D at Capital Times.

He has 13 years of experience in asset management and investment analytics.

One of the leading macroeconomists in Ukraine, in 2021 he foresaw the risk of a full-scale Russian invasion as a worst-case scenario for Ukraine.

a.shcherbyna@capital-times.com

Share On